Submerchants can withdraw funds from their ledger account balance once they’ve completed KYC verification. You can integrate withdrawals into your platform using Whop’s embedded components or by redirecting submerchants to Whop’s hosted withdrawals portal.

Submerchants can withdraw funds from their ledger account balance once they’ve completed KYC verification. You can integrate withdrawals into your platform using Whop’s embedded components or by redirecting submerchants to Whop’s hosted withdrawals portal.

Global reach

Whop supports withdrawals to over 140 countries, making it easy for submerchants worldwide to access their funds in their local currency and preferred payment method.Supported withdrawal methods

Submerchants can withdraw funds using multiple payment methods:- Bank transfers: Direct transfers to bank accounts in supported countries

- Mobile wallets: Send funds to popular mobile wallet services

- PayPal: Withdraw directly to PayPal accounts

- Venmo: Withdraw to Venmo accounts (US only)

- Cryptocurrency: Withdraw to crypto wallets

The available withdrawal methods depend on the submerchant’s country and

currency. Not all methods are available in all regions.

Withdrawal options

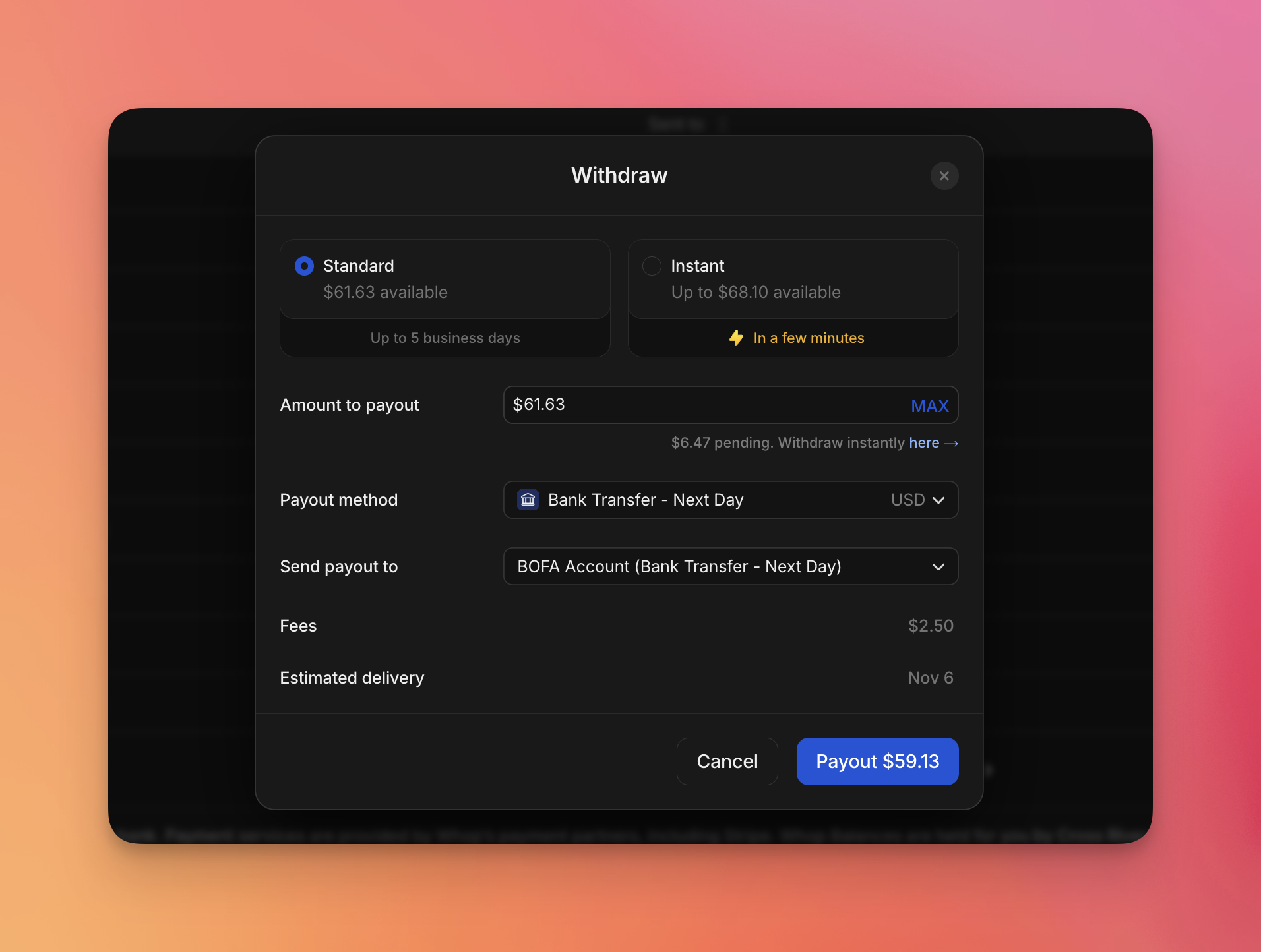

You have two options for handling withdrawals:Option 1: Embedded withdrawals

Use Whop’s embedded components to host the withdrawals flow directly on your platform’s website. This provides a seamless experience where submerchants never leave your site. Benefits:- Seamless user experience on your platform

- Full control over the UI/UX around the withdrawals flow

- No redirect away from your site

Option 2: Hosted withdrawals portal

Send submerchants to Whop’s hosted withdrawals portal. This is the simplest option and requires no frontend integration. Benefits:- No frontend integration required

- Always up-to-date with latest features and payment methods

- Minimal development effort

Withdrawal requirements

Before a submerchant can withdraw funds, they must:- Complete KYC verification: The submerchant must have completed the KYC onboarding process

- Have available balance: Funds must be settled and available in their ledger account

- Meet minimum thresholds: Some withdrawal methods may have minimum withdrawal amounts